Calculating the value of common stock is a fundamental concept in finance and investing. Common stock represents ownership in a corporation, giving shareholders a claim on the company’s assets and earnings. Understanding how to calculate the value of common stock can help investors make informed decisions regarding buying, selling, or holding their shares. This article will delve into the methods of calculating common stock value, the factors influencing its price, and the implications for investors.

Understanding Common Stock

Common stock is a type of equity security that represents ownership in a company. Holders of common stock typically have voting rights and may receive dividends, although these are not guaranteed. The value of common stock is influenced by various factors, including the company’s financial performance, market conditions, and investor sentiment.

Methods to Calculate Common Stock Value

There are several methods to calculate the value of common stock, including:

1. Dividend Discount Model (DDM)

The Dividend Discount Model is one of the most common methods used to value common stock. This model assumes that the value of a stock is the present value of its expected future dividends. The formula for calculating the value of common stock using the DDM is:

P0=D1(r−g)P_0 = \frac{D_1}{(r – g)}P0=(r−g)D1

Where:

- P0P_0P0 = Current price of the stock

- D1D_1D1 = Expected dividend next year

- rrr = Required rate of return

- ggg = Growth rate of dividends

Example: If a company is expected to pay a dividend of $2 next year, the required rate of return is 10%, and the dividends are expected to grow at a rate of 5%, the calculation would be:

P0=2(0.10−0.05)=20.05=40P_0 = \frac{2}{(0.10 – 0.05)} = \frac{2}{0.05} = 40P0=(0.10−0.05)2=0.052=40

So, the estimated value of the stock would be $40.

2. Price-to-Earnings Ratio (P/E Ratio)

The Price-to-Earnings (P/E) ratio is another method to estimate the value of common stock. The P/E ratio compares a company’s current share price to its earnings per share (EPS). The formula is:

P0=P/E×EPSP_0 = P/E \times EPSP0=P/E×EPS

Where:

- P0P_0P0 = Current price of the stock

- P/EP/EP/E = Price-to-earnings ratio

- EPSEPSEPS = Earnings per share

Example: If a company has an EPS of $4 and the average P/E ratio in its industry is 15, the calculation would be:

P0=15×4=60P_0 = 15 \times 4 = 60P0=15×4=60

Thus, the estimated stock price would be $60.

3. Net Asset Value (NAV)

The Net Asset Value method estimates the value of a company’s stock based on the value of its assets minus its liabilities. The formula is:

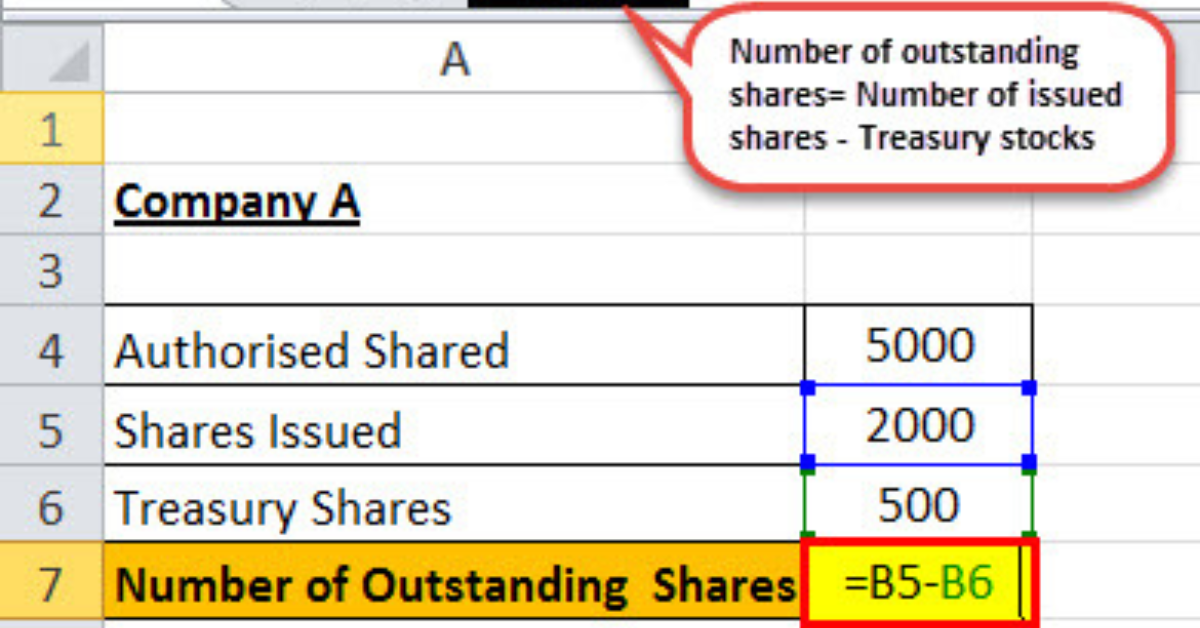

NAV=(TotalAssets−TotalLiabilities)NumberofSharesOutstandingNAV = \frac{(Total Assets – Total Liabilities)}{Number of Shares Outstanding}NAV=NumberofSharesOutstanding(TotalAssets−TotalLiabilities)

Example: If a company has total assets of $1,000,000 and total liabilities of $600,000, with 100,000 shares outstanding, the calculation would be:

NAV=(1,000,000−600,000)100,000=400,000100,000=4NAV = \frac{(1,000,000 – 600,000)}{100,000} = \frac{400,000}{100,000} = 4NAV=100,000(1,000,000−600,000)=100,000400,000=4

In this case, the estimated value per share would be $4.

Factors Influencing Stock Value

The value of common stock is influenced by various internal and external factors:

- Company Performance: Earnings reports, revenue growth, and profit margins significantly impact stock prices.

- Market Conditions: Economic indicators, interest rates, and market sentiment can lead to fluctuations in stock value.

- Industry Trends: The performance of an entire industry can affect individual stocks, especially if the company is a key player within that sector.

- Dividends: The frequency and amount of dividends can influence investor perceptions and stock value.

- Management Decisions: Corporate actions, such as mergers and acquisitions or changes in management, can also impact stock prices.